🚅 NCR Mega-Hub

The Future of High-Velocity Fulfillment & Premium Retail

A National Expansion of the MyxxMarket Ecosystem

1. Executive Summary

MyxxMarket is a tech-enabled, hybrid online mall and premium logistics platform that allows OFWs, foreign clients, and corporates to purchase goods, book services, and pay bills for loved ones —

all through one seamless checkout and delivery orchestration.

After 5 years of proof-of-concept in Cebu, we are scaling to NCR (Valenzuela City) by establishing a 5,000 SQM Mega Hub, the central brain for a nationwide hub-and-spoke network. This Mega Hub will oversee 17 small hubs across NCR (16 cities + Pateros), ensuring same-day delivery for all orders.

Funding Ask

₱180M for 25% equity, representing the full NCR rollout cap.

This covers:

-

Mega Hub lease, setup, and infrastructure

-

Fleet acquisition and logistics

-

Staff payroll

-

Proprietary WMS & tech

-

Marketing to reach OFWs and corporates

-

Integration of anchor stores, vendor shops, and services

2. The Cebu Proof-of-Concept (2021–2025)

5 years of continuous operations

-

₱1M annual revenue generated organically

-

Zero paid marketing spend

-

Fulfilled orders during Typhoon Odette, demonstrating operational resilience

-

0% churn among repeat OFW customers

Cebu validates:

-

Real demand for combined goods + cash delivery

-

High trust from OFW customers

-

Operational repeatability under stress conditions

3. The NCR Mega Hub (4,000 - 5,000 SQM Mother Hub)

Location: Valenzuela City, near NLEX/Skyway Stage 3 → fast access to Makati, BGC, and QC

-

Size: Flexible 4,000–5,000 SQM, depending on warehouse availability and lease costs

Size: Flexible 4,000–5,000 SQM, depending on warehouse availability and lease costs

Mother Hub Functions

-

Warehouse & Fulfillment: store anchor products and vendor inventory; orchestrate city-wide deliveries

-

Premium Lounge & Membership Area: 50 stations with tablets/self-order kiosks for premium members

-

Integrated F&B: coffee, pizza, snacks (high-margin, optional revenue)

-

Digital Picking & WMS: AI-driven batching, multi-hub cloud sync

Hub Area

Staff Count

Orders/Day (5k SQM)

Warehouse & Pickers

40

200–300

Lounge & Concierge

30

Support & premium services

Fleet & Delivery

18

Manages 50 riders + 10 vans

Small Hubs (17 x 1–2 staff)

17

60–70 combined

Total

105

300–600 orders/day

Warehouse & Fulfillment: store anchor products and vendor inventory; orchestrate city-wide deliveries

-

Premium Lounge & Membership Area: 50 stations with tablets/self-order kiosks for premium members

-

Integrated F&B: coffee, pizza, snacks (high-margin, optional revenue)

-

Digital Picking & WMS: AI-driven batching, multi-hub cloud sync

Hub Area | Staff Count | Orders/Day (5k SQM) |

|---|---|---|

Warehouse & Pickers | 40 | 200–300 |

Lounge & Concierge | 30 | Support & premium services |

Fleet & Delivery | 18 | Manages 50 riders + 10 vans |

Small Hubs (17 x 1–2 staff) | 17 | 60–70 combined |

Total | 105 | 300–600 orders/day |

-

17 Small Hubs across NCR

-

1–2 staff per hub

-

Focused on last-mile delivery and local fulfillment

-

Optional minimal storage depending on city demand

Example:

An OFW orders Jollibee + Red Ribbon cake + cash for Pasay → Pasay hub fulfills immediately under Mother Hub supervision.

This structure keeps:

-

Fixed costs low

-

Response times fast

-

Scaling modular and controllable

17 Small Hubs across NCR

1–2 staff per hub

Focused on last-mile delivery and local fulfillment

Optional minimal storage depending on city demand

Example:

An OFW orders Jollibee + Red Ribbon cake + cash for Pasay → Pasay hub fulfills immediately under Mother Hub supervision.

This structure keeps:

-

Fixed costs low

-

Response times fast

-

Scaling modular and controllable

5. Services & Experience

|

6. Operational Complexity & Risk Mitigation

Two-staff small hub model: One picks items, one documents via photos/videos

-

Consolidation station: Combines products from multiple vendors

-

Same-day delivery: All orders completed and dispatched same-day

-

Multiple simultaneous orders: Managed via prioritization and batch consolidation

-

Order issue protocol: Immediate buyer notification and solution discussion; refunds issued if necessary

-

Proven in real-life: Typhoon Odette disruption handled efficiently, building buyer trust

-

Investor takeaway: Operational complexity is controlled, efficient, scalable, and builds credibility

7. Special Concierge Payments

Electricity, tuition, subscriptions, foreign payments with optional markup

-

Integrated into the same platform

-

Adds high-margin revenue without extra logistics

8. Vendor Expansion & Investment Portal

Vendors registering in MyxxMarket can pitch for funding to expand regionally

Example: Cebu bakery replicates in Manila → investor funds new small hub

Network effect: more vendors → more products → more OFWs served → more revenue

Platform earns commission or equity from funded expansions

9. Revenue Model

Revenue Stream | Description |

|---|---|

Anchor Stores | Gifting, groceries, gadgets |

Tenant Vendors | Commission via Dokan dashboards |

Services & Experiences | Clowns, barbers, events |

Special Payments | Bills, tuition, foreign payments |

B2B / Corporate Orders | Bulk orders for employees |

Premium Membership | 5K members × ₱800/year → ₱4M recurring |

F&B Lounge | 50–60% margin on food & drinks |

Vendor Investment Fees | Equity from funded vendor expansions |

Conservative scenario: 184 orders/day Year 1

Aggressive scenario: 600 orders/day fully utilized 5k SQM hub

10. Staffing & Payroll (18Months)

Technology & WMS (₱110M): AI-driven batching, tablet hardware, and multi-hub cloud sync.

Hub Fit-Out (₱80M): Cold storage, high-density racking, and 50-station Lounge.

Last-Mile & Ops (₱125M): 18 months of payroll for 98 staff + fleet acquisition.

Marketing (₱95M): Scaling our Cebu organic model across NCR and global OFW corridors.

Working Capital (₱40M): Inventory & operational support for 17 small hubs.

11. Marketing Budget (25M - 30M Initial)

Social Media Ads (FB, IG, TikTok)

OFW-targeted campaigns in US, Canada, Australia

Google Ads / SEO

PR / Media / Partnerships

Launch promotions, discounts, membership drive

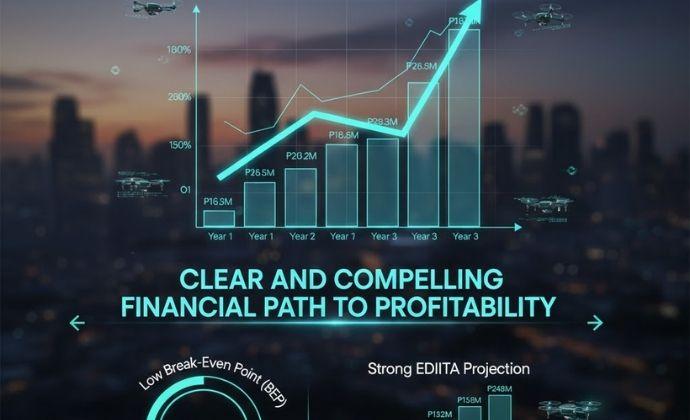

12. 5-Year Financial Projections

Metric | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

Gross Revenue | ₱672M | ₱1.34B | ₱2.01B | ₱2.61B | ₱3.13B |

Gross Profit (30%) | ₱201.6M | ₱402M | ₱603M | ₱783M | ₱939M |

OpEx & Logistics | ₱186.1M | ₱270M | ₱355M | ₱410M | ₱480M |

EBITDA | ₱15.5M | ₱132M | ₱248M | ₱373M | ₱459M |

Net Margin | 2.3% | 9.8% | 12.3% | 14.2% | 14.6% |

ROI Scenarios:

-

Conservative → 100% total ROI (5 years)

-

Aggressive → 155% total ROI (5 years)

Conservative → 100% total ROI (5 years)

Aggressive → 155% total ROI (5 years)

13. Strategic Use of Funds(180M)

Purpose | Amount (₱M) |

|---|---|

Tech & WMS | 50 |

Hub Fit-Out | 40 |

Last-Mile & Ops | 50 |

Marketing | 25 |

Working Capital / Inventory | 15 |

14. 4-Hub National Roadmap

Phase 1: NCR Mega Hub (Valenzuela)

Phase 2: Visayas Hub (Cebu)

Phase 3: Luzon Hub (Tarlac)

Phase 4: Mindanao Hub (Davao)

Each Mega Hub oversees small hubs in its region. Supports OFWs, foreign clients, corporates, and vendors — enabling rapid nationwide replication.

15. Investors FAQs

- Q1. Why ₱180M per Mega Hub?

Covers lease, hub setup, tech, staff, fleet, marketing, and inventory integration. Q2. How do small hubs operate?

1–2 staff per hub, optional inventory, orders routed via Mega Hub WMS.Q3. How does one checkout handle multiple products/services?

Platform integrates anchor stores, tenant vendors, services, and bill payments in a single transaction.Q4. What services are supported?

Curated services like clowns, barbers, party coordination, surprise experiences.Q5. Can vendors expand nationally?

Yes, via integrated investment portal. Investors can fund vendors’ replication in new regions.Q6. Corporate clients?

Platform supports bulk orders (e.g., Coca-Cola example), fully integrated with small hubs and Mega Hub orchestration.Q7. What is the projected ROI?

Conservative: 100% in 5 years. Aggressive: 155% in 5 years.Q8. How is platform revenue diversified?

Goods, services, memberships, corporate B2B, vendor commissions, F&B, bill payments.Q9. How is operational risk mitigated?

Proven Cebu proof-of-concept, robust WMS, hub-and-spoke model, trained staff.- Q10. Why is this attractive to investors?

Multiple revenue streams, scalable network, proven traction, OFW trust, high-margin opportunities, nationwide replication.

Conclusion

The NCR Mega Hub + 17 small hubs creates a fully operational, staff-focused, phygital fulfillment network:

-

One platform → multiple revenue streams

-

One checkout → multiple products, services, and payments

-

Hub-and-spoke architecture → national coverage

-

Vendor investment portal → scalable ecosystem

-

₱180M funding → accelerates nationwide replication

-

155% ROI aggressive scenario → realistic, high return potential

MyxxMarket is positioned to be the leading premium fulfillment and online mall brand in the Philippines.

Check Related Topics:

THE Mega-Hub Project Frequently Ask Questions

THE Mega-Hub 180-Day Pre-Launch Roadmap

THE Prospectus: The Mega-Hub Vision

THE Math: Unit Economics, Scalability, & Financial Stability

THE Deal: Structure, Governance, & Investors Rights

THE Mega-Hub Detailed Marketing Strategy

Join Our Community!

Be an Investor:

Franchise Our Business Model:

Our Online Mall in Cebu:

Email Us:

FB Page:

MyxxMarket Online Mall Network

YouTube Channel: